About Me

Driven by data, passionate about markets.

I am a dedicated Mathematics and Computer Science student at the University of Virginia with a strong interest in quantitative finance. My academic journey is focused on building a deep understanding of algorithms, data structures, and statistical modeling.

Outside of the classroom, I am actively involved in the UVA Geometry Lab, Cavalier Trading, and pursuing personal projects in machine learning and trading systems. I thrive on solving complex problems and am eager to apply my skills in a fast-paced, results-oriented environment like a hedge fund.

Work Experience

Professional roles and achievements

Quant Research Intern

- Building a ML model on 5,000+ past fund events to predict continuation fund likelihood in GP-led secondaries.

- Scraped 20,000+ company SEC fillings to enable live tracking of transfer agent market behavior; supported alternative signal generation by engineering features used in downstream alpha research. - (Under NDA)

- Leveraged knowledge in Python, Pandas, Bloomberg Terminal, Capital IQ API, Web-Scraping, SQL, Excel

Machine Learning Intern

- Enhanced live occlusion detection systems by building signal-filtering algorithms, reducing false positives by 15%.

- Engineered 8 validation protocols generating over 100,000+ time-series data points on pump performance (flow rate stability, thermal drift); structured outputs for downstream anomaly detection and predictive modeling.

- Leveraged knowledge in Python, MATLAB, R, Random Forest, Time Series Transformers, Git, Docker

Research Experience

Academic research and publications

Undergraduate Thesis Researcher

- Investigating high-frequency liquidity in tokenized equities using a state-space & Hawkes-process framework.

- Implementing Kalman-filter efficient-price extraction, rolling 30-min VECM for dynamic information-share, bivariate Hawkes models to see how one trade sparks another, and liquidity metrics with (effective/realized spread)

- Leveraged knowledge in Python - (pandas, statsmodels, web3.py), Bloomberg Terminal, Web-Scraping, Plotly

Applied Mathematics Researcher

- Developed forward and inverse kinematic algorithms to enhance robotic arm precision and control.

- Presented research findings in 3 public forums, including graduate seminars and community events.

- Leveraged knowledge in Python, Linear Algebra, Differential Equations, Neural Networks, GNNs, PyTorch

Education

Academic background and achievements

University of Virginia

Majors

Activities

Key Coursework

Technical Skills

Languages and technologies I use

Frontend

JavaScript

advancedHTML/CSS

advancedReact

intermediateNext.js

intermediateBackend

Python

expertJava

advancedC/C++

intermediateNode.js

intermediateDatabase

SQL

advancedJSON

advancedDevOps

AWS

intermediateFeatured Projects

Applying theory to practice

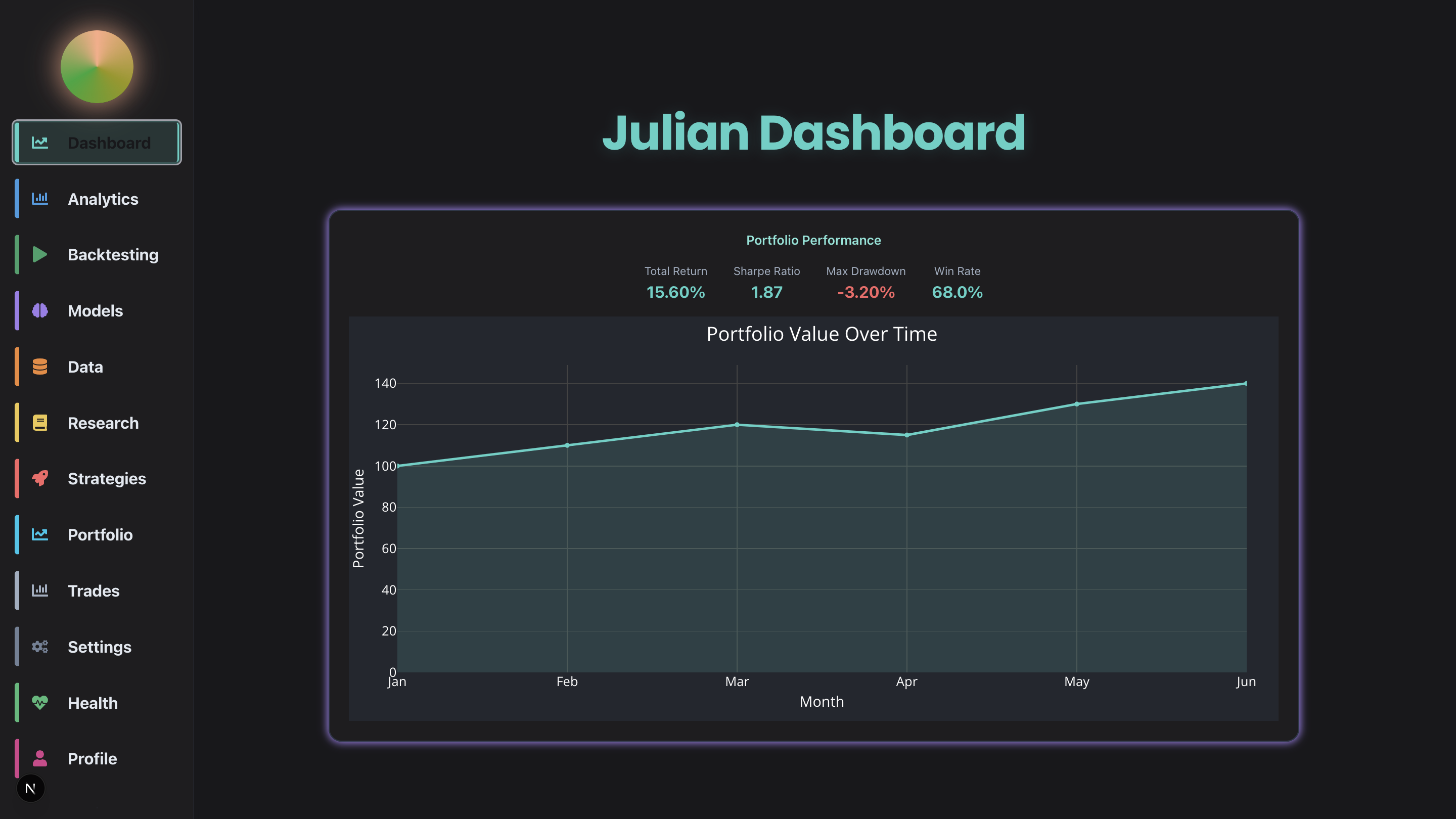

Julian Quant Platform

Developed a modern, modular quant research and trading platform featuring a TypeScript/React dashboard, Python FastAPI backend, backtesting engine, and real-time analytics.

LEARN MORE

IMC Prosperity Trading Challenge

Achieved a top 1.7% global ranking (217th out of 12,000+) in IMC's 15-day trading simulation competition. Engineered python trading strategies including statistical arbitrage, z-score pairs trading, directional options trading using Black-Scholes valuation encompassed by adaptive inventory management and latency handling.

LEARN MORE